Open loop and Omnichannel Digital Wallet

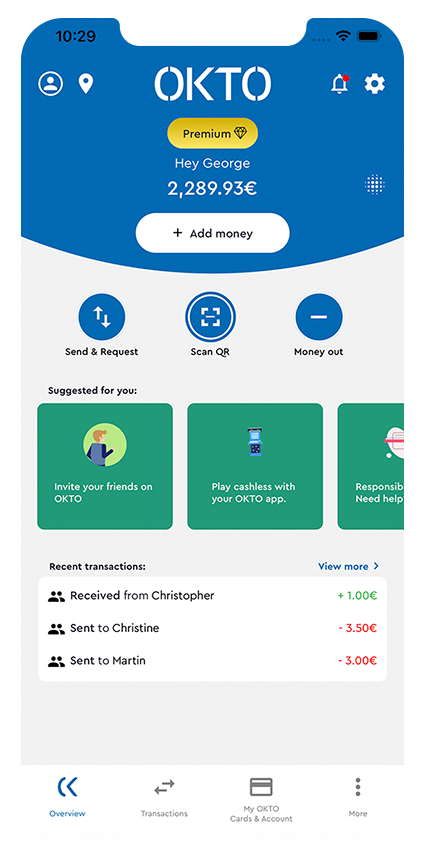

OKTO.WALLET is a compliant, open-loop, and omni-channel payment solution aiming to reduce payment friction while enhancing the payment experience via real-time e-money funds transfers in a responsible, secure, and fast way.

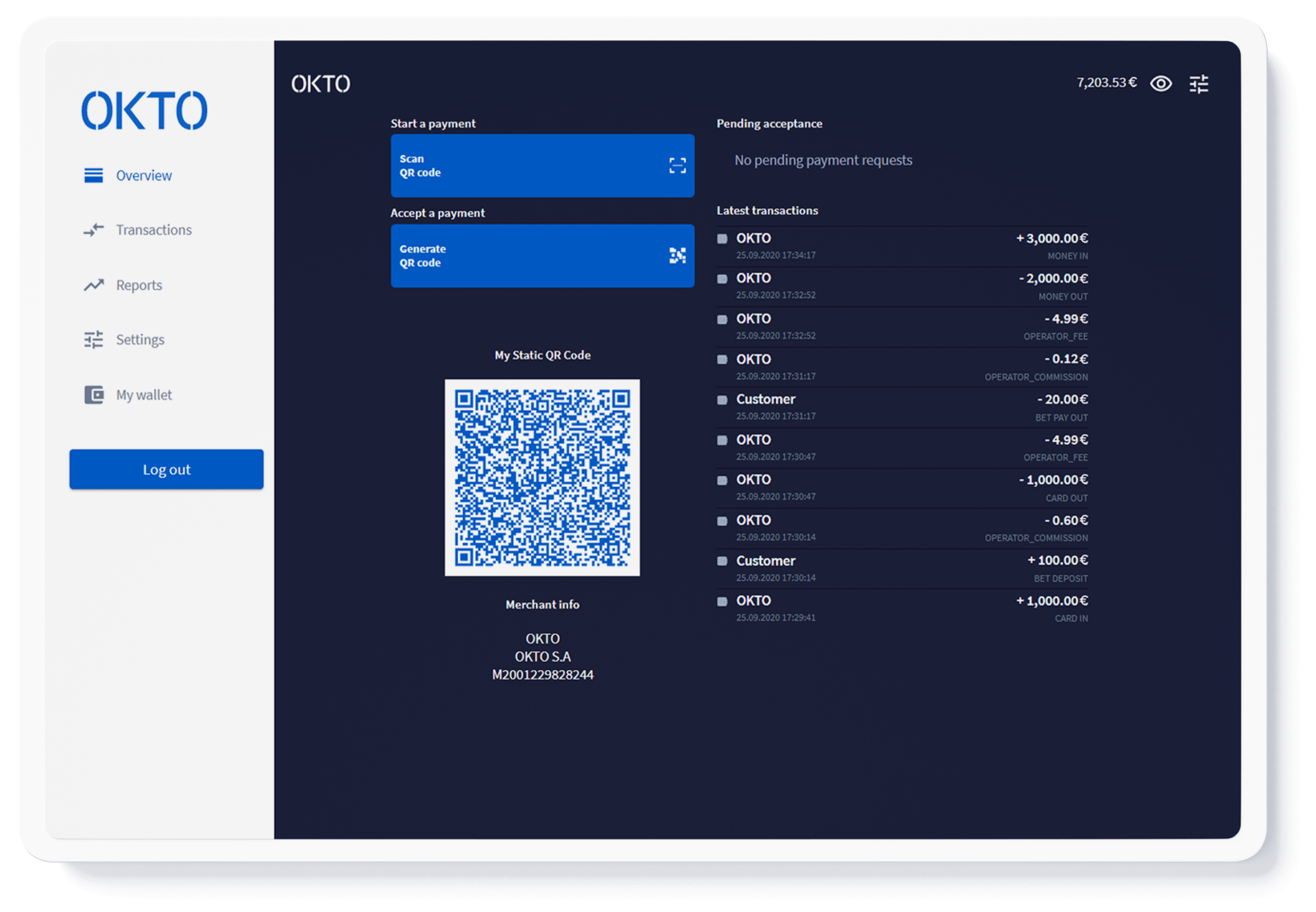

API-Driven

Being API-driven delivers numerous benefits to your business, and your customers. Our digital wallet includes an API for connection to central management systems, a core transacting wallet engine, anti-fraud mechanism, as well as the player OKTO App and the merchant app with associated wallets and supportive web apps. Our powerful system offers extensive back-office and reporting tools. What’s more, by working with OKTO, you have the ability to integrate loyalty programs and additional value-added services – it’s a totally complete solution.

We’re digitalising user experiences for journeys across the entire retail and online ecosystem …

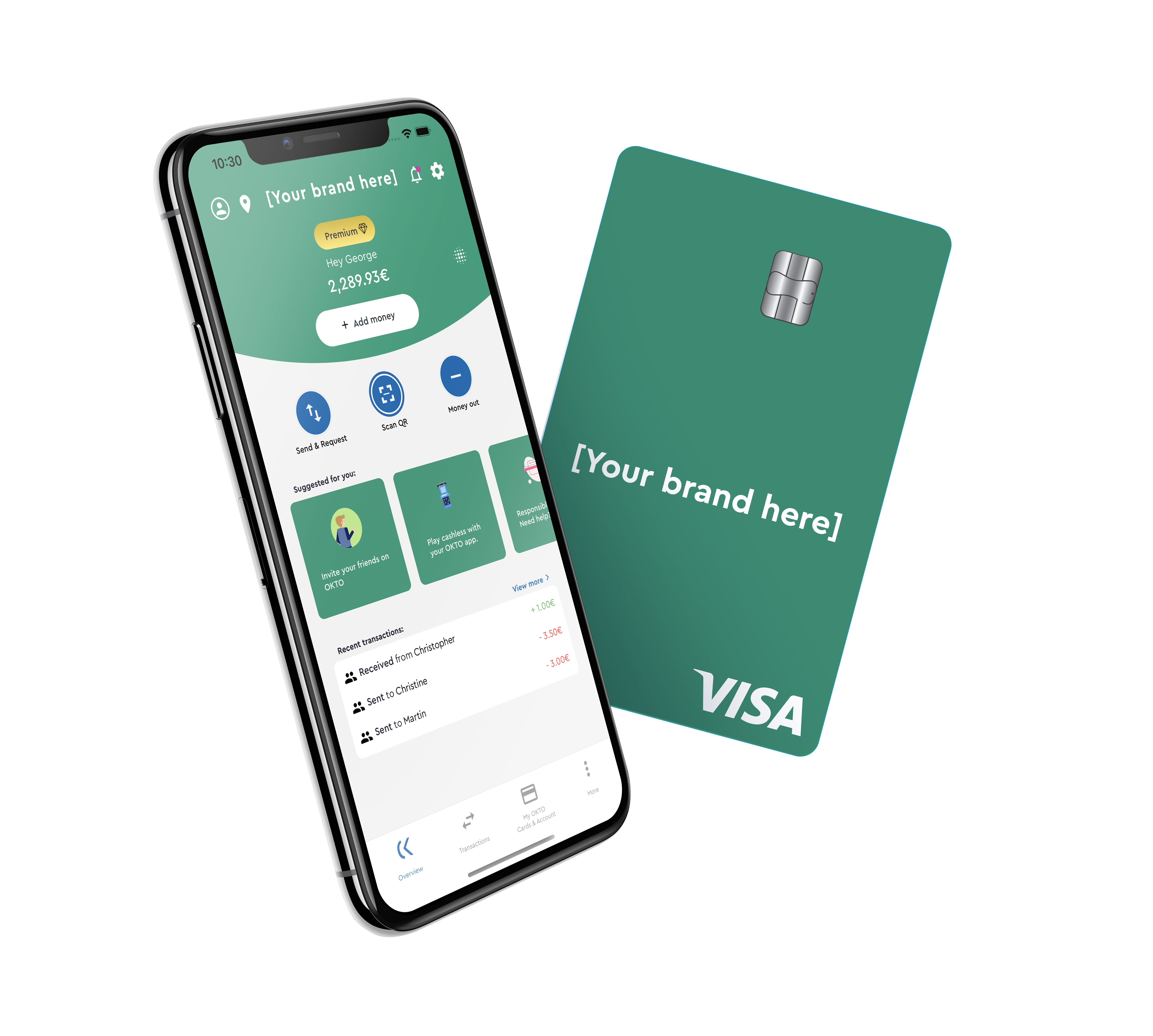

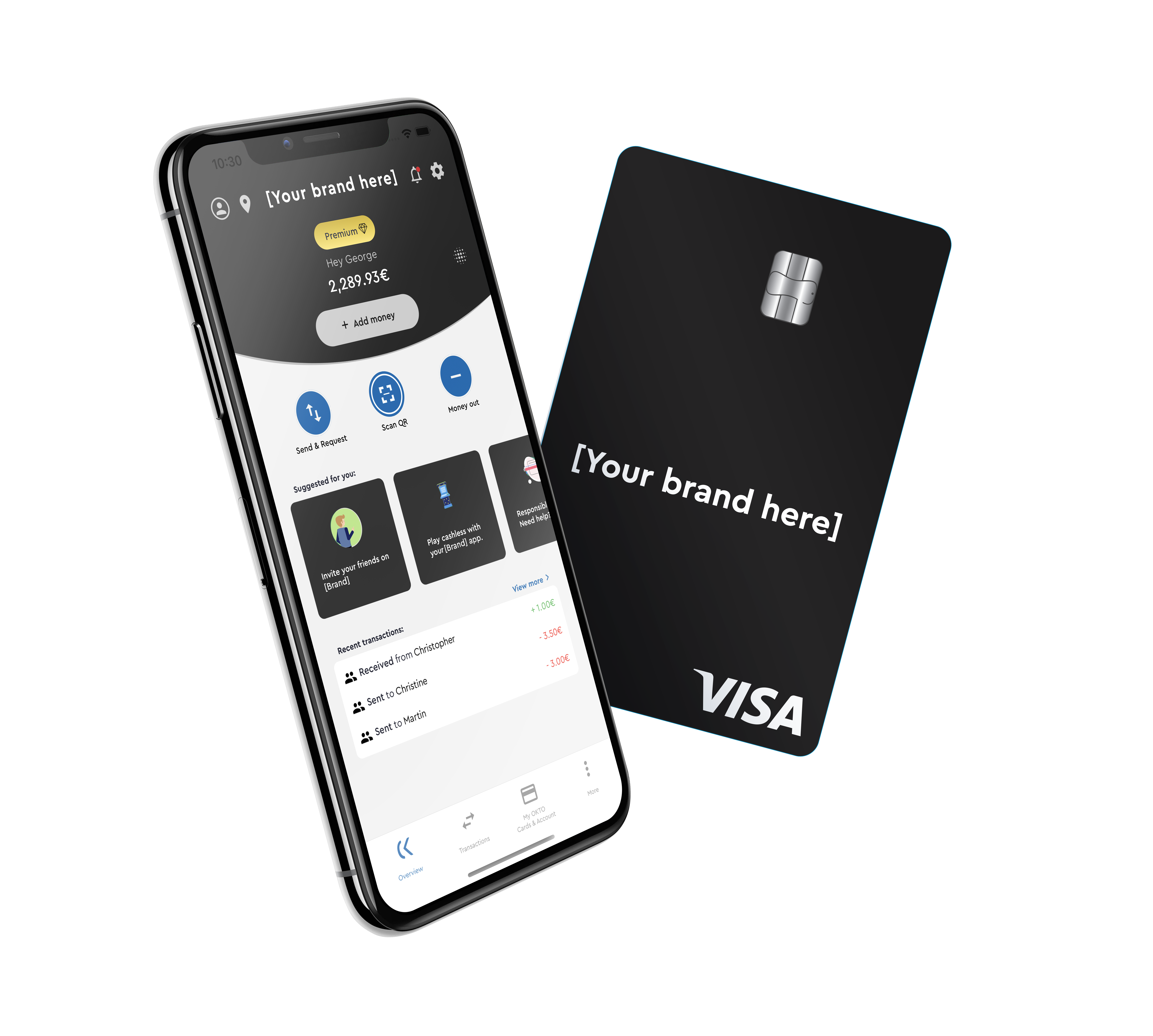

We cover the entire payments ecosystem with a true omnichannel payment solution, OKTO.WALLET. This powerful tool can be integrated at virtually every touchpoint, across all verticals and channels.

The open-loop nature of the app gives players more freedom, enabling them to move and use their funds as they wish instantly. With OKTO.WALLET, customers are able to make transactions anywhere that Mastercard is accepted. That’s because the OKTO virtual and physical Mastercard is linked directly to users’ accounts.

Socially Responsible

Our transparent solution helps foster responsible habits, allowing for cool-off periods, fully monitored transaction histories, as well as an easy-to-use profit and loss control feature.

Our in-app KYC checks are unparalleled, and by combining them all together into a single solution, we’re able to offer the most comprehensive and responsible solution on the market.

The Benefits of OKTO

We empower new and traditional businesses around the world to embrace the value of digitalization and innovation. Advance Identity & age verification in a safe KYC environment based on actual documentation and no proxys.